Navigating the world of credit can be difficult, but grasping the nuances of credit card pre approval, particularly with a respected business like Capital One, can lead to financial empowerment and freedom.

This comprehensive guide will walk you through the elements of Capital One’s credit card pre-approval process, ensuring you have the knowledge you need to make sound financial decisions.

Contents

What Does Credit Card Pre Approval Really Mean?

Pre approval is a preliminary signal from a credit card provider that you meet certain requirements for their credit products. It is based on a simple assessment of your financial information and frequently results in a soft credit check, which is a non-invasive look at your credit history that has no effect on your credit ratings.

Benefits of Pre-Approval

Avoiding a hard credit check:

- Capital One’s pre approval process begins with a soft credit check, which has no influence on your credit score. Only when you actually apply for the card will a hard credit check be performed, which may cause your credit score to drop slightly.

Finding the appropriate card for your needs:

- Pre approval allows you to identify credit cards that fit your credit profile and narrow down your options effectively.

Capital One’s Credit Card Varieties

Capital One has a variety of credit cards for different credit levels:

For Fair Credit:

- QuicksilverOne Rewards: Get 1.5% cash back on all buys. You might get a higher credit limit after 6 months.

- Platinum Credit Card: Great for building credit. No yearly or hidden fees.

For Good Credit:

- Savor One Rewards For Good Credit: Earn cash back on eating out and entertainment.

- Quicksilver One Rewards For Good Credit: Enjoy 1.5% cash back on everything you buy.

For Excellent Credit:

- Venture One Rewards: Perfect for travelers. Earn big rewards on travel spending.

For Rebuilding Credit:

- Capital One Secured Credit Card: Start with a refundable deposit. Use the card responsibly and you might get a higher credit limit.

Top Cards for Prequalified Offers

Capital One also offers top-tier cards for those who prequalify, such as:

- Venture Rewards Credit Card: Best for travelers with flat-rate rewards on every purchase.

- Quicksilver Cash Rewards Credit Card: Known for its cash back on every purchase.

- Savor Cash Rewards Credit Card: Ideal for those who spend on dining and entertainment, offering high cash back rates in these categories.

Get Pre Approved A Step by Step Guide

Getting pre-approved for a Capital One credit card is straightforward. Here’s a step-by-step guide to help you through the process:

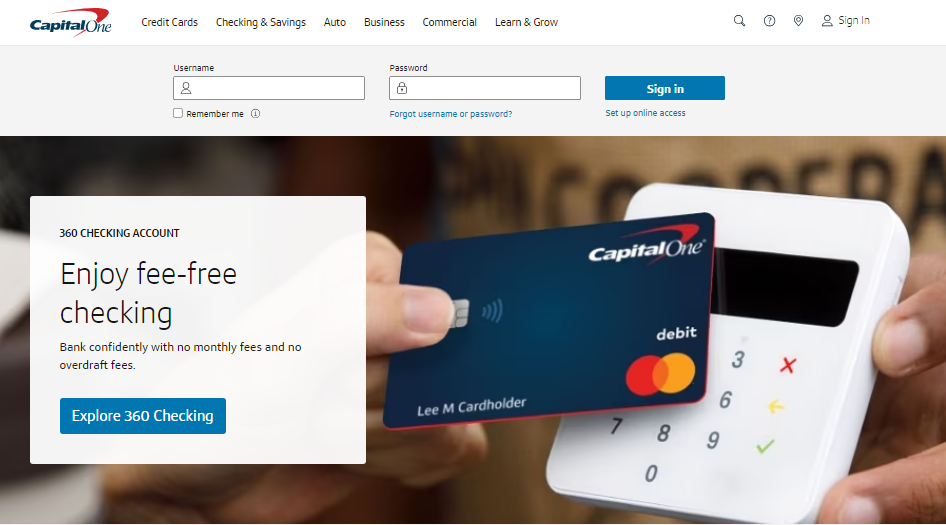

Step 1: Visit Capital One’s Website

- Go to the official Capital One website (https://www.capitalone.com/).

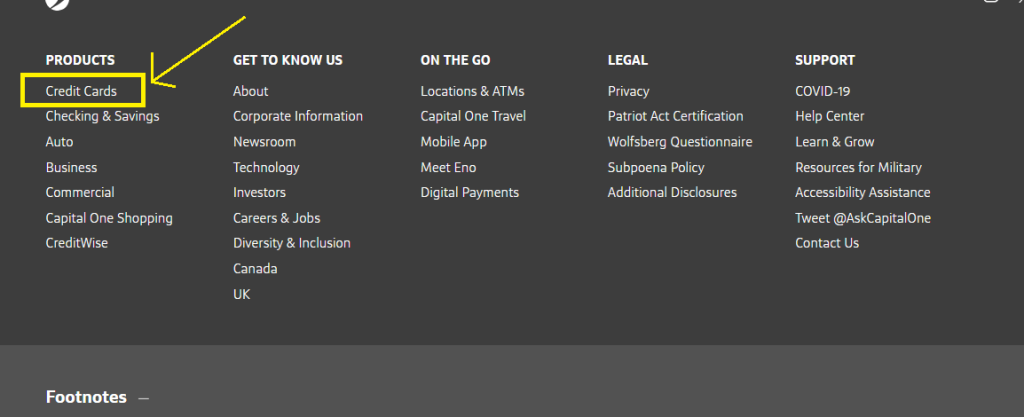

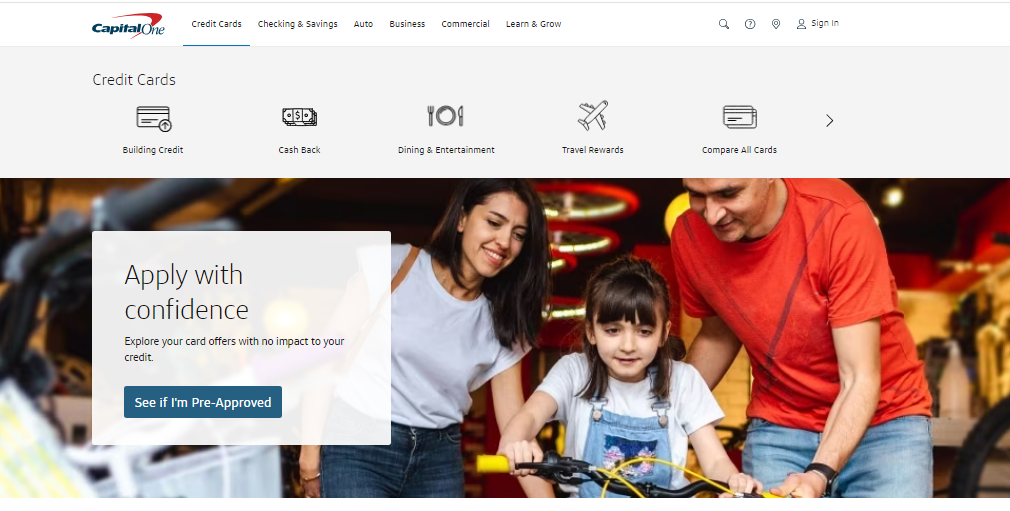

- Find the ‘Credit Cards‘ section and look for the pre approval page.

Step 2: Provide Your Information

- Fill out the pre-approval form.

- You’ll need to provide some basic details like your name, address, income, and Social Security number.

Step 3: Answer Pre-Approval Questions

- Answer questions about what you’re looking for in a credit card, such as low interest rates or cash back rewards.

Step 4: Review Your Offers

- After submitting the form, you’ll see the cards you’re pre-approved for based on your financial information.

- This involves a soft credit check, which doesn’t affect your credit score.

Step 5: Choose a Card (Optional)

- Review the card options and their benefits.

- If you find one that suits your needs, you can proceed to apply.

Step 6: Apply for the Card (Optional)

- Applying will involve a hard credit check, which may impact your credit score slightly.

- Fill in the necessary application details.

Step 7: Wait for Approval

- After submitting your application, wait for the response from Capital One.

- If approved, you’ll receive your card and can start using it based on the terms and conditions.

Conclusion

Getting pre approved for a Capital One credit card is not just about getting a new card. It’s a smart way to check your financial health and pick the right credit card for you. Whether you want cash back, travel points, or to improve your credit score, Capital One has a variety of cards to fit your needs. Start your journey to better finances now!