Navigating the world of credit cards can be complex, but GetMyOffer.CapitalOne.com simplifies the process, offering a tailored selection of Capital One’s credit card offers. This article provides a comprehensive guide to understanding and utilizing this platform.

What is Getmyoffer According to Capitalone?

Capital One’s Get My Offer credit card invitation program sends out bespoke offers to pre selected individuals based on their credit profile.

It streamlines the application process by allowing invitees to rapidly apply for a card by entering a reservation number and access code at GetMyOffer.CapitalOne.com, providing easier access to Capital One’s numerous credit card possibilities.

GetMyOffer CapitalOne Overview

| Name | Getmyoffer Capitalone |

|---|---|

| Website | https://capitalone.com/ |

| Languages Available | English |

| Partner | Capital One |

| Managed By | Capital One Financial Corporation |

| Country | USA (United States of America) |

| Contact | 1-877-383-4802 (For general customer service) |

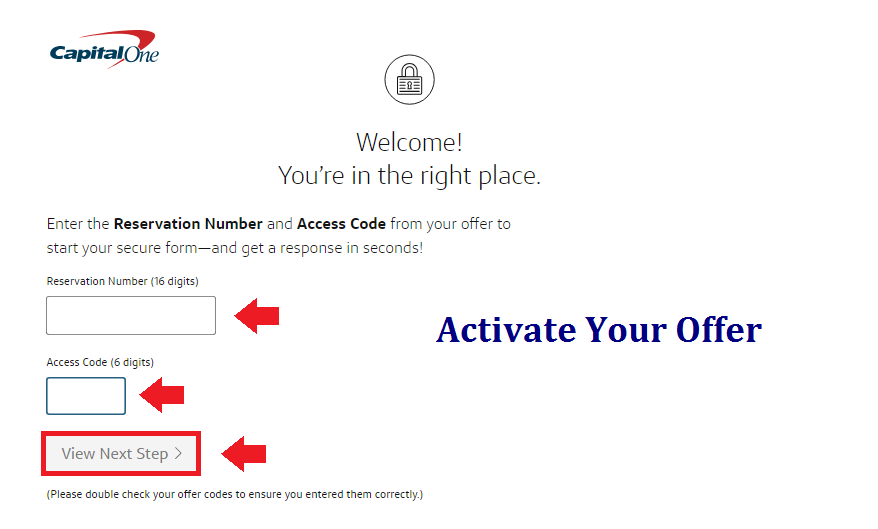

Activate Your Offer With getmyoffer.capitalone.com

To activate your Capital One credit card offer from GetMyOffer.CapitalOne.com, follow these steps:

Step 1:- Visit the Website:

- First of all you click on GetMyOffer.CapitalOne.com.

Step 2:- Enter Information:

- Input the 16 digit reservation number and 6 digit access code found on your mail offer.

Step 3:- Submit Application:

- Complete the application form with your personal and financial details.

Step 4:- Wait for Approval:

- After submitting the application, wait for Capital One’s decision.

Step 5:- Activate Your Card:

- Once approved and you receive your card, follow the instructions provided with the card to activate it, usually through Capital One’s website or by phone.

Step 6:- Set Up Online Account:

- Consider setting up an online account for easy management of your new credit card.

Find Your Reservation Number and/or Access Code

Your reservation number and access code are usually included in the promotional email you receive from Capital One as part of the GetMyOffer campaign. Here’s how to find them.

Check the Mail Offer:

- Look at the letter or promotional material sent to you by Capital One.

Locate the Numbers:

- Usually, the reservation number and access code are prominently displayed on the mailer. They might be located near the bottom or in a clearly marked section.

Note the Details:

- The reservation number is generally a long series of numbers, while the access code is shorter. Both are crucial for responding to the offer.

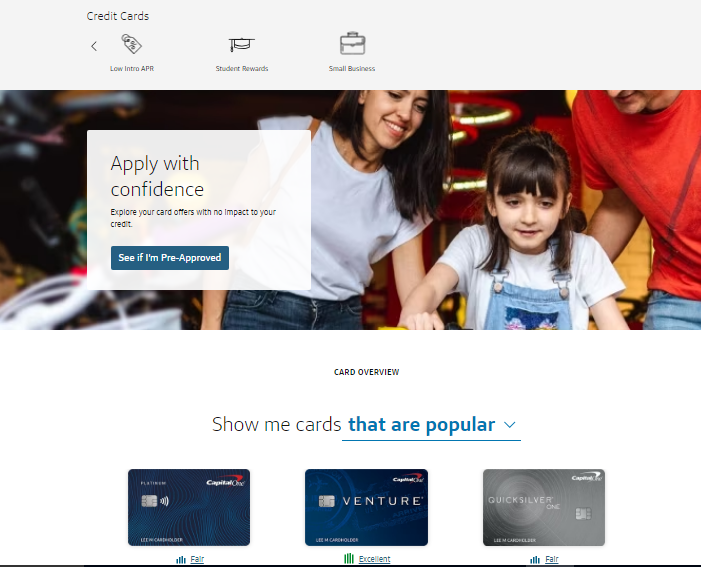

Have you Not Received any offer through mail? so do this

If you haven’t received a mail offer, you can still explore Capital One’s credit card options:

- Visit: Go to GetMyOffer.CapitalOne.com to check pre qualification.

- Pre Qualify: Click on the “See if you pre qualify” section.

- Provide Info: Enter your name, address, and last four digits of your Social Security number for a soft credit inquiry.

- Review Offers: Look at the credit card offers you pre qualify for.

- Apply: If an offer appeals to you, apply directly on the website.

Apply for a Capital One Credit Card

Applying for a Capital One credit card is easy. Here’s how:

Apply Before:

- Know What You Need: Think about what you want in a credit card rewards, low fees, or low interest rates.

- Check Your Credit: Understand your credit score; it helps in choosing the right card.

- Explore Cards: Visit the Capital One website, look at different cards, and compare their benefits.

- Pre Qualify (Optional): Use Capital One’s online tool to see which cards you might get without hurting your credit score.

Apply Process:

- Go to the Capital One website and navigate to the credit card section.

- Choose the card you are interested in and click ‘Apply Now’.

- Fill in the application form with all the required information, including your personal, financial, and employment details.

- Review the terms and conditions of the card, then submit your application.

- Wait for Response: You’ll either get an instant decision or a message saying they’ll review your application more.

- Activate Your Card: Once you get your card, follow the instructions to activate it.

- Set Up Online Account (Optional): Manage your card easily by setting up an online account with Capital One.

Choose The Best Offer From Getmyoffer.Capitalone.Com

Choosing the best offer from GetMyOffer.CapitalOne.com can be simple:

- Think about what you need from a credit card rewards, building credit, or low interest.

- Carefully check the offer’s details like fees, interest rates, and rewards.

- Look at how different cards reward you for your spending, especially in categories you often use.

- Note any annual or extra fees and ensure the benefits are worth it.

- See if there are sign up bonuses and if you can meet the spending requirements.

- Pick an offer that suits your credit score to increase your chance of approval.

- Check what others say about the card’s service and rewards.

Benefits of Choosing Capital One

Capital One is more than simply a credit card company; it is a hub for financial opportunities. The organization is well known for its robust internet banking, customer centric attitude, and dedication to financial education. Capital One offers a variety of credit card options and excellent information at GetMyOffer.CapitalOne.com to assist with financial decision making.

Credit cards can be powerful financial tools when used wisely. To maximize their benefits:

- Choose the Right Card: Research and select a card that aligns with your spending habits and financial goals.

- Understand Terms and Conditions: Be aware of interest rates, fees, and rewards programs.

- Pay Your Balance in Full: Avoid interest charges and maximize rewards by paying your balance in full each month.

- Earn Rewards: Use your card for everyday expenses and pay off the balance in full to benefit from rewards without incurring interest charges.

- Leverage Sign Up Bonuses: Take advantage of sign up bonuses but avoid overspending to reach the threshold.

Featured Credit Card Options

Capital One offers credit cards for a variety of needs:

- QuickSilver Card: Great for cashback. If you spend $500 during the first 90 days, you will receive 1.5% back on your purchases as well as a $150 incentive. There is no yearly charge, and you must have a high credit score.

- Savor Card: Ideal for food and entertainment. Get 4% back on dining and entertainment, 2% on grocery, and 1% on other items. It requires a high credit score and has a $95 annual fee.

- Platinum Mastercard is ideal for credit building. After 6 months, your credit line is automatically increased, and you can see your credit report for free. It requires a decent credit score and has no annual fees.

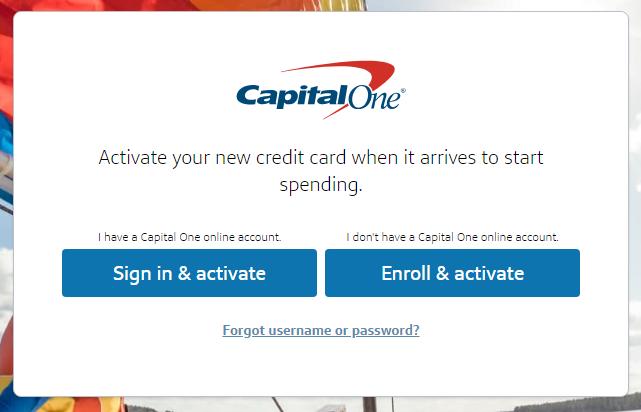

Activate Capital One Credit Card

Activating your Capital One credit card is easy:

To activate your new Capital One card, follow these steps:

- Visit the Website: Go to the activation page at verified.capitalone.com.

- Choose Your Option: You’ll see two buttons ‘Sign in & activate’ and ‘Enroll & activate’.

- Existing Users: If you already have a Capital One account, click ‘Sign in & activate’ and log in.

- New Users: If you’re new, click ‘Enroll & Activate’ to set up an online banking account and activate your card.

If you forgot your login password and username then click on this link: Forgot username or password

Capital One Mobile App

The Capital One Mobile app allows you to manage your finances with simplicity. You may check your account balances, see recent transactions, and monitor your account activity. Paying bills and transferring funds between accounts or to other banks is simple.

The software also allows you to deposit checks with your phone’s camera and has the useful capability of locking or unlocking your credit card if it is misplaced. Credit Wise also allows you to monitor your credit score and establish specific notifications for account activity.

The app is available for download from the App Store or Google Play, and you can login in with your Capital One online account information.

Getmyoffer Capital One Customer Support

General customer support line Call customer support at 1-844-348-8660

- General Questions: Call 1-877-383-4802 for banking or credit card issues.

- Online Banking Help: Dial 1-866-750-0873 for online banking support.

- Credit Card Issues: For billing or rewards, call 1-800-227-4825.

- Outside the US: Reach them at (804) 934-2001 for international support.

Conclusion

So, friends, this is all about Getmyoffer.capitalone.com and the amazing credit cards from Capital One. Remember, having a credit card is a big responsibility. Always spend wisely and pay your bills on time. If you’re ready to explore and get a card, visit Getmyoffer.capitalone.com and see the magic yourself!

FAQs

Q1. What is Getmyoffer.capitalone.com?

Ans:- Getmyoffer.capitalone.com is a website where you can check if you’re pre approved for a credit card from Capital One.

Q2. How do I check if I am pre approved for a credit card?

Ans:- Simply visit Getmyoffer.capitalone.com, enter your reservation number and access code, and you’ll see if you’re pre approved.

Q3. What do I need to apply for a card on Getmyoffer.capitalone.com?

Ans:- You need your reservation number and access code, which you receive by mail, along with personal details like your income and employment information.

Q4. Is it safe to apply for a credit card on Getmyoffer.capitalone.com?

Ans:- Yes, it’s safe. Capital One uses secure technology to protect your personal information.

Q5. How long does it take to get a response after applying?

Ans:- After submitting your application on Getmyoffer.capitalone.com, you’ll usually get a quick response.

Q6. Can I apply for a Capital One card if I didn’t receive a pre approved offer?

Ans:- Yes, you can still apply for a Capital One card directly on their main website or in person at a branch.

Q7. What kind of credit cards can I find on Getmyoffer.capitalone.com?

Ans:- You’ll find a range of cards suitable for different needs, including cards for building credit, earning cashback, or accumulating travel rewards.

Q8. What should I do if I haven’t received my reservation number and access code?

Ans:- If you haven’t received these details, you can visit the Capital One website and fill out the ‘Find My Offer’ form or contact their customer service.

Q9. How can I check the status of my application?

Ans:- You can check the status by logging into your Capital One account or by contacting Capital One customer service.

Q10. What if I’m not happy with my pre approved offer?

Ans:- If you’re not satisfied with the offer, you can explore other credit card options on the main Capital One website or consider other providers.